Get rich quickly with Bitcoin?

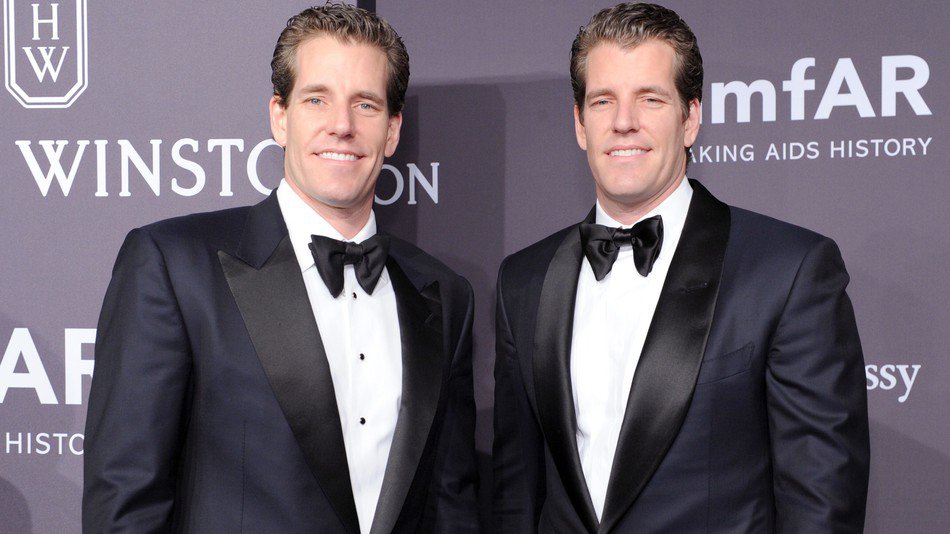

That’s what the Winklevoss Twins of Social Network fame did.

I’m amused by Bitcoin’s meteoric rise and plunge. Aren’t you?

Bitcoin started 2017 below $1,000 and hit $19,345 on December 19, 2018.

Then the price . . .

- plunged to $6645 a year later mid December 2019

- rocketed almost to $29,000 in December 2020

- hit a peak of $68,789 on November 10, 2021

- closed at $19,896 on August 30, 2022

As Stevie Nicks sang, “The sea changes color, but the sea does not change.”

Manias change but a maniac’s behavior does not.

It seems that the less investors understand about a mania’s object, the more obsessed they are to own it at any price.

Not a wise plan.

I’m not going to argue the pleasure of a venture highly rewarded.

Is anything better than scoring big on investments?

How about good returns over a long time? Boring?

What about good health from great habits? Mundane?

Even when health is good, stress is bad if money is tight.

Folks think about money all the time.

Most Americans are living one of 3 financial nightmares.

- In debt even with high income

- Paycheck to paycheck with little savings

- Overloaded with discontent and dissatisfaction

No wonder bitcoin is in the headlines!

But, after studying, writing and speaking on financial topics for forty years, I believe in three blazing rules for finding and keeping financial freedom in a chaotic world.

Blaising Financial Rule #1: No home runs

Every investment that takes off like a rocket usually falls like a rock.

That doesn’t mean it’s a bad investment.

It’s just that folks often gamble money with more risk than they can afford.

“You only find out who’s swimming naked when the tide goes out.” Warren Buffet

So, my first rule of investing comes from baseball.

- “No home runs. Just singles and doubles.” SB

- “Time and energy required for home runs are better invested in singles and doubles.” SB

- “Don’t look for instant results. Look for consistent results.” SB

Invest in what you know makes sense and your peace of mind will stay in tact every season.

Blaising Financial Rule #2: Focus on the core

Never abandon your core interest to chase a satellite interest.

How many times has a doctor lost his shirt chasing a restaurant?

Just remember. . .

- Always reinvest in the core

- Never let the tail wag the dog

- Never take from the good to feed the bad

“STOP & ASK: Will the same time and energy I’m putting into the satellite make more money in the core?” SB

Blaising Financial Rule #3: Avoid the Las Vegas syndrome

“I’ll be back in an hour honey, I just want to get even.” Las Vegas Syndrome

How many deals have you stayed in simply to get even?

I had lunch with a celebrated Dallas entrepreneur recently.

He said his investment success was simple.

“When one piece of junk I own starts to go down, I sell it and buy another piece of junk that’s going up.”

How about that plan?

Save your skin and remember that peace-of-mind investing is not to get even, but to progress!

Stay smart, not cute, with your money

- No home runs

- Avoid the Las Vegas syndrome

- Focus on the core not the satellite

What’s your favorite financial rule?

Spot on Steve as usual – I am amazed how we continue to learn new things even after 71 years of life!

Mark Cuban – It only has value because of the “narrative”. Whomever controls the narrative controls the value. Proof : B Gates says he likes productive assets like farmland (vs Bitcoin/NTFs) and Bitcoin goes south

Thanks Jeff for two pieces of wisdom from some very bright guys!