Don’t laugh at the possibility of a global financial collapse.

It almost happened ten years ago and I still can’t believe it.

On Sunday September 14, 2008, the Treasury Secretary of the United States was on his cell phone down the hall from his office so no one could hear him.

Hank Paulson was panic stricken and he wanted to talk to his wife Wendy.

“What if the system collapses? Everybody is looking to me, and I don’t have the answer. I am really scared.” Henry M. Paulson Jr., On the Brink: Inside the Race to Stop the Collapse of the Global Financial System

Let that sink in for a minute.

Could you ever imagine the Treasury Secretary of the United States scared?

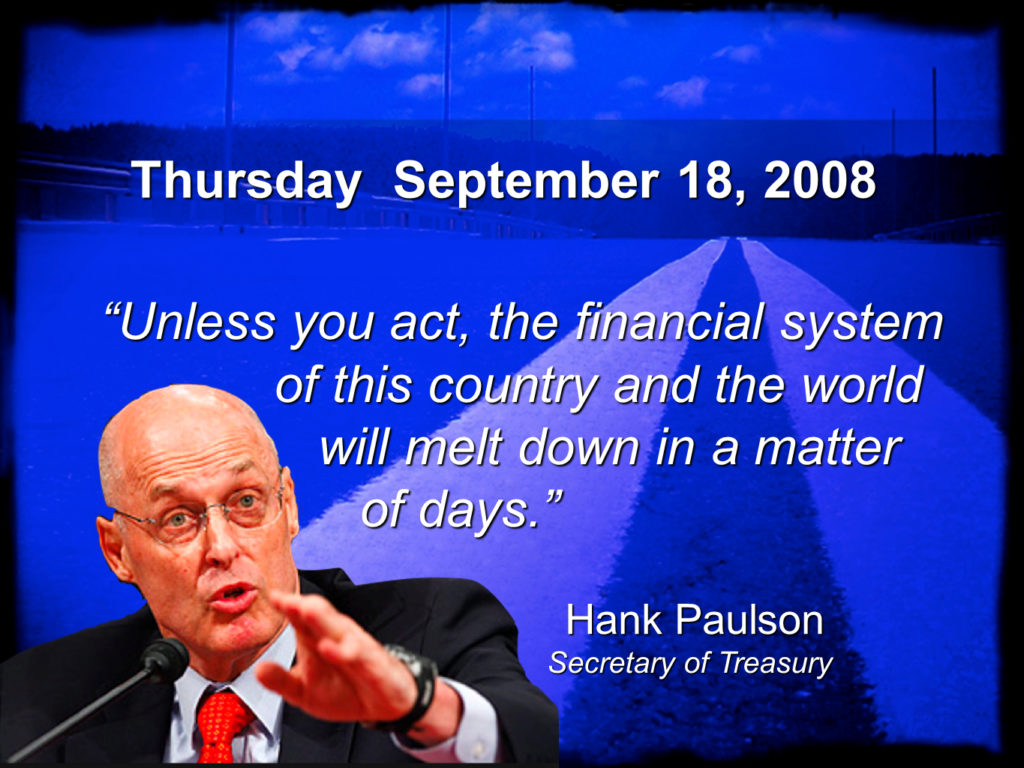

Days later he pleas with every leader of our government for quick action.

Here are four things to know about the possibility of another collapse.

1. Worldwide credit almost disappeared

Imagine the world financial system with no access to credit.

That’s what Hank Paulson and Ben Bernanke were freaking about on September 18, 2008.

Credit markets seized up days after Lehman Brothers filed bankruptcy.

- AIG was gasping for air with an $85 billion Fed loan.

- Money market funds faced billions in redemptions.

- Interest rates on Treasuries went negative.

People were now willing to pay the government for safety.

The wheels were flying off the financial system.

Treasury Secretary Hank Paulson told key White House staff on September 18, 2008 . . .

“This is the economic equivalent of war. The market is ready to collapse.” On the Brink, p. 254

I couldn’t believe how fast the U.S. economy was disappearing before our eyes.

2. Collapse Friday, September 19, 2008

I was at a U.T. alumni breakfast when three J.P. Morgan bankers at my table jumped up with their cell phones lighting up and ran out of the Park City Club.

Might as well escape for a weekend of college football!

So, I hopped in my car for a long drive down I-35 hoping this financial nightmare would disappear in college festivities.

But then, I walk into my hotel room and turn on the news.

Senator Chris Dodd is at a press conference taking questions about what was said at an emergency meeting with Fed Chair Ben Bernanke and senior leaders of Congress.

“What was the mood in the meeting senator?”

Ashen faced Chris Dodd paused and said, “You could hear the air leave the room.”

I’ve had my fill of air-leaving-room days in the last ten years.

Witnessing the world economy swirl in chaos like whipped cream in 2008 takes the cake!

While folks watched their 401k evaporate like neighborhoods in a wildfire, anyone with money wondered if this was the end.

3. Greed precedes financial calamity

The lesson from this crisis is how fast greed destroys wealth.

Mortgages were repackaged and sold multiple times by bankers, brokers and hedge fund players.

Making money was easy and the fools were the innocent.

Why?

Because greed is a wildfire and America has a history of not making reforms without a crisis.

4. The next crisis may stir social chaos

Low interest rates from the Financial Crisis gave advantages to the wealthy.

But, many folks are range-bound in wages. And now an era of rising interest and inflation rates is burning up the income of the middle class.

This leads to anger and rage which leads to showdowns like Chicago or Venezuela.

When a city or nation gets angry, they elect angry politicians.

Tariffs are a byproduct of that anger and sow even more division among nations.

Eventually, those policies make nations angrier and that leads to war.

5. A safety bet for all

“The prudent see danger and take refuge, but the simple keep going and pay the penalty.” Proverbs 22:3

The penalty for what?

- For being blind to the obvious

- For refusing to act on what you see

Our national debt is over $31 trillion as of 1/17/2023.

Just four years ago it was $21 trillion.

A worldwide calamity will punish everyone captive to debt.

After 68 years on this planet, I’m convinced that three things are necessary for a wealthy and peaceful life.